Simplify your business and get paid faster.

Australia’s favourite all-in-one payment solution with low fees, top tier security and same day support.

-

Trusted By 5000+

Aussie Businesses -

Industry

Leading Security -

99% Uptime

Guarantee -

Australian

Owned & Operated

Grow your business with Australia’s favourite online payment provider.

Increase revenue.

Boost sales and keep customers happy by accepting Visa, Mastercard, credit cards, and digital wallets.

Streamline operations.

Streamline operations with automated payment processing and sync directly to your bank account.

Pay less fees.

Cut unnecessary costs and keep more money with low transaction fees from leading payment processors.

Get fast support.

No more being ghosted by tech support. Get same-day service with our 24/7 team.

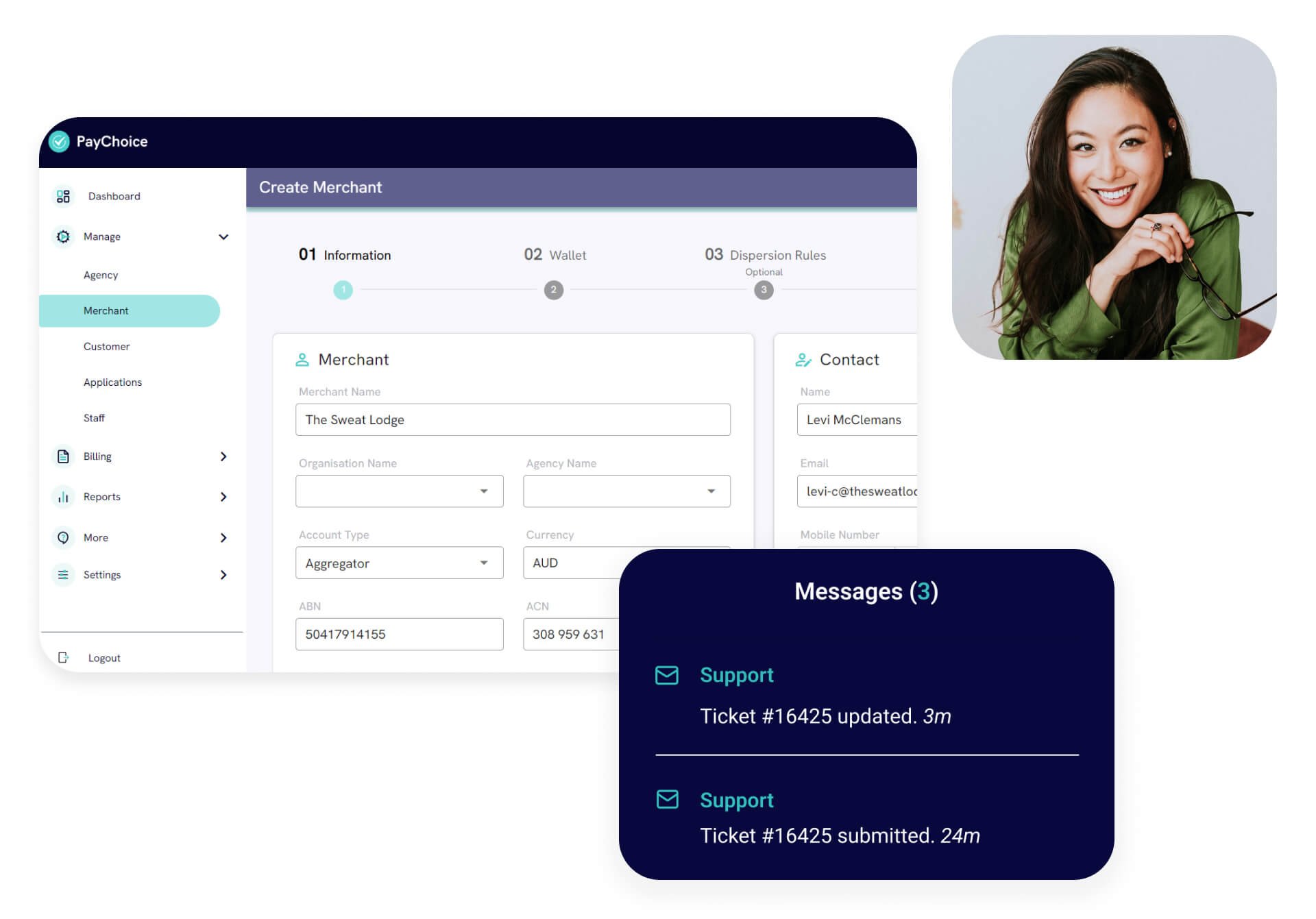

All your payment needs in one place.

Whether you’re a startup looking to get up and running, or an established business looking to streamline operations and cut unnecessary costs, we’ll help you set up the options that suit your business best. Start with what you need today, then add more as you grow.

-

Direct Debits

Say goodbye to chasing up payments with direct debits. A set and forget solution, perfect for memberships, subscriptions with recurring payments

-

Online Payments

Say goodbye to chasing up payments with direct debits. A set and forget solution, perfect for memberships, subscriptions with recurring payments

-

Eftpos

Say goodbye to chasing up payments with direct debits. A set and forget solution, perfect for memberships, subscriptions with recurring payments

-

API Web Services

Say goodbye to chasing up payments with direct debits. A set and forget solution, perfect for memberships, subscriptions with recurring payments

How to use Paychoice to grow your business.

-

Make getting paid easy. Automate your recurring payments with direct debits so customers are billed on time, every time.

No chasing invoices, no awkward follow-ups, and no missed payments. Perfect for memberships, subscriptions, programs, or ongoing services. Simply set it once and let PayChoice handle the rest.

-

Need to collect a one-off payment fast? Create and send secure payment links in seconds. Perfect for deposits, cancellations, overdue invoices, or quick purchases without needing a website or terminal.

-

If you’re not already taking online payments, we make it a breeze. With Paychoice you can sell products, services, sessions, memberships, digital items and more with fast and secure online checkout options.

Whether you already have a website or are starting from scratch, we give you everything you need to accept payments instantly.

-

Whether you need your first Eftpos terminal or you’re ready to switch providers, PayChoice makes it easy.

Fast setup, reliable machines, lower fees and quick payouts. A simple, seamless way to take in-person payments without any of the usual headaches.

-

Most businesses are paying more than they should on transaction fees. When you switch to PayChoice, you save on processing costs so more money stays in your business.

No hidden fees, no complicated pricing, just a more cost-effective way to take payments every day.

-

Slow payments hurt your cashflow. PayChoice helps you get paid faster through automated billing, online payments, instant checkout links and fast settlement. Less waiting, less admin, and more predictable revenue coming in each week.

-

Keep everything connected and running smoothly. With our API web services, you can integrates directly with your existing software so payments, customer details and billing information stay perfectly in sync.

No more exporting spreadsheets, retyping customer info, or fixing data errors. Just one system that talks to your other systems, so nothing gets missed and nothing breaks.

Industries We Work With

Easily connect to your software.

PayChoice integrates with your existing payment systems and payment processors, so you can kiss goodbye to double handling and manually following up customers.

Find out how you could save with PayChoice.

We’ve helped thousands of businesses streamline payment processing and accept multiple payment types. Get in touch with our friendly team to see how it works and why thousands of businesses have switched to our Australian payment gateway.

Get started in 4 easy steps.

Free Quote

We’ll catch up for a call, discuss your needs and give you a clear, upfront quote based on your business and the payment tools you need.

Contact Us

Send us a message to get in touch with our team.

Free Onboarding

We handle the setup for you, integrating with your software, configuring payments and making sure everything works smoothly.

Ongoing Support

Start taking payments right away, with ongoing support from our team whenever you need it.

Australian Payment Gateway FAQ

-

An Australian payment gateway is a service that securely processes online or in-person payments for Australian businesses — authorising and routing payment data between a customer’s card/bank, the acquiring bank, and the merchant.

-

When a customer pays (online, in-person, or via phone), the gateway encrypts their payment details and sends them to the payment processor/acquiring bank.

The bank checks that the funds are available and authorises (or declines) the payment; the gateway communicates the result to your site or POS system.

Once approved, the transaction is settled and funds are transferred to your business account (timing depends on the provider / bank).

-

With PayChoice’s Australian payment gateway, you can accept:

Credit & debit cards (e.g. Visa, Mastercard)

Direct debits (ideal for recurring payments/subscriptions)

BPAY and likely other local payment methods (depending on setup)

In-person payments via Eftpos / card terminals (where supported)

-

Low transaction fees — PayChoice advertises some of the “lowest fees on the market,” helping you keep more of your revenue.

Flexible payment options — PayChoice supports multiple methods (cards, direct debit, BPAY, Eftpos), giving customers flexibility.

Seamless integration — Works with many existing eCommerce platforms or software; if not listed, PayChoice offers custom integration at no extra cost.

Security & compliance — Uses bank-grade security standards (PCI DSS Tier 1) to protect payment data.

Local (Australian) support & same-day assistance — With a fully Australian team, PayChoice offers fast, local support if issues arise.

-

For real-time payments or payments via their payment link / card / direct debit methods, PayChoice can provide same-day settlement or at least quicker settlement than many traditional gateways, improving cash flow.

-

Yes — as an Australian payment gateway, PayChoice adheres to relevant security standards (PCI DSS Tier 1), and supports typical Australian payment methods (cards, BPAY, direct debit, Eftpos) as per local market norms.

-

Absolutely. PayChoice’s direct debit system is ideal for recurring billing (memberships, subscriptions, regular services). This automates payment collection and helps maintain steady cash flow.